Private Equity Investor Management Software

Automate the investment lifecycle and delight your investors.

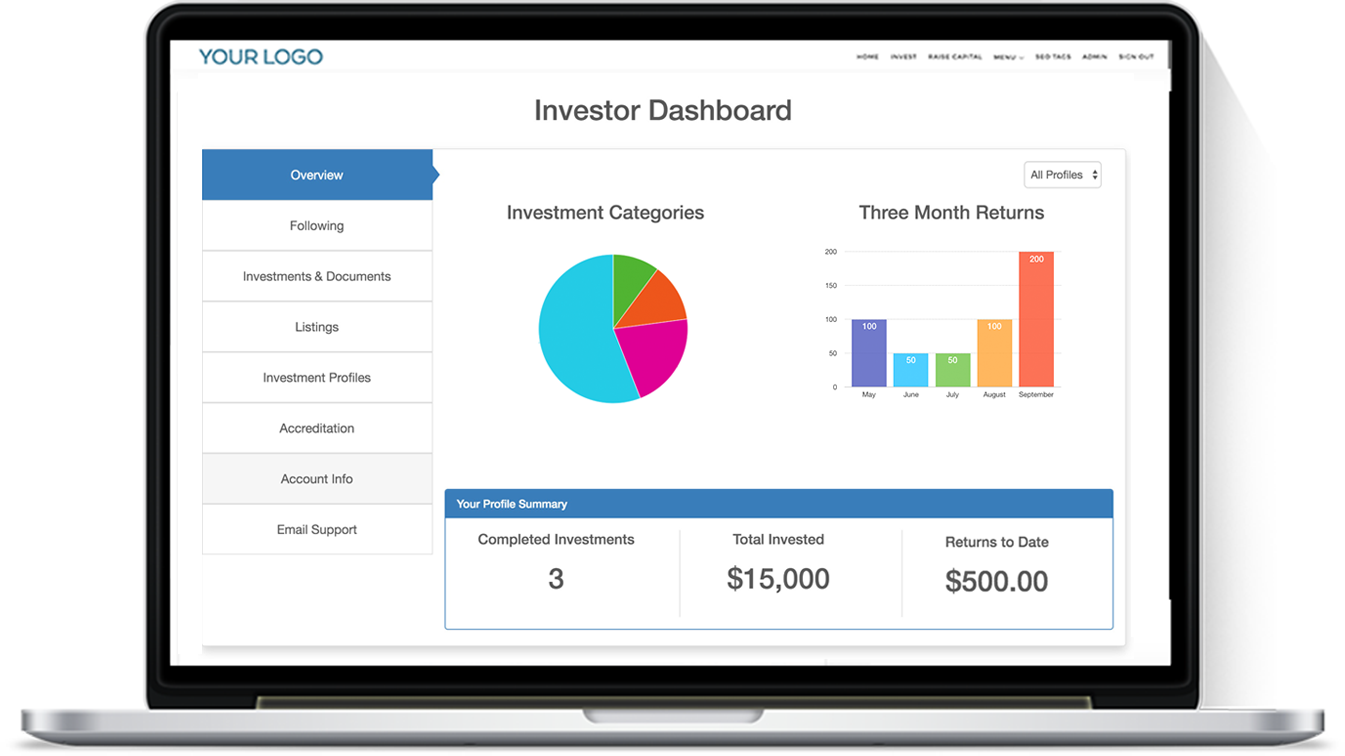

Make Investors Happy

Giving investors the ability to make and manage their investments online is no longer optional. Dashboards, charts, documents, tax forms, earning reports, messaging, and more. We can even build custom reports for your specific needs.

Automate Your Business

From investor onboarding to back office management, our software can help you reduce risk, save time, and ensure compliance.

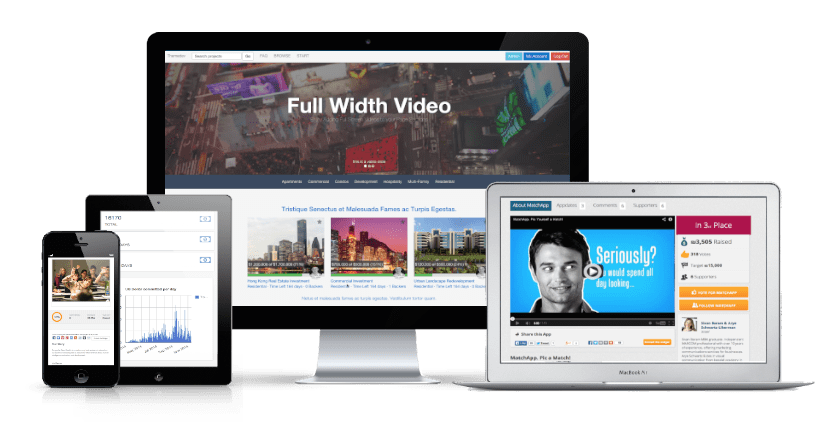

More Flexibilty

We can customize our software for your specific business needs or optionally license our front-end source code for and use your own front-end developer. We also offer an API for building custom apps or integrating reports in your legacy applications.

Streamline your private equity business with the most powerful funding platform on the market

Private Fundraising

- Reg. D 506(b)

- Private Deals

- Accredited Investors Only

- Investor Requests Access

Public Fundraising

- Reg. D 506(c), Reg. S, Reg. A+

- General Solicitation

- Accredited & Non-Accredited

- International

Our private equity asset management solution can be used for capital raises of all kinds including traditional DPO's, REITs, Opportunity Zones, syndication, and more.

Cardone raised over $72 million using CrowdEngine. We looked at every option and no one had the functionality or flexibility of CrowdEngine.

We recently closed an offering with CrowdEngine’s software. When we needed some changes, CrowdEngine worked with us to deliver them so we could make this work for our business. They’ve been fantastic!

We chose CrowdEngine to build our funding portal because we needed a system that was advanced enough to handle our investment process, but easy enough to use that our team could succeed. The CrowdEngine team is exceptional.

CrowdEngine has aided us in institutionalizing all our platforms and continue to partner us on key initiatives as they arise in a professional, friendly and timely manner. Their deliverables far exceeded our expectations.

Key CRE Features

We have 100's of customizable features, but here are a few top features for Private Equity.