Security Token Issuance

Sell a Security Token

or Launch a Security Token Platform

We can help you tokenize existing assets or raise capital.

Tokenization

Tokenize existing assets, and sell tokens via your own token sale portal or platform.

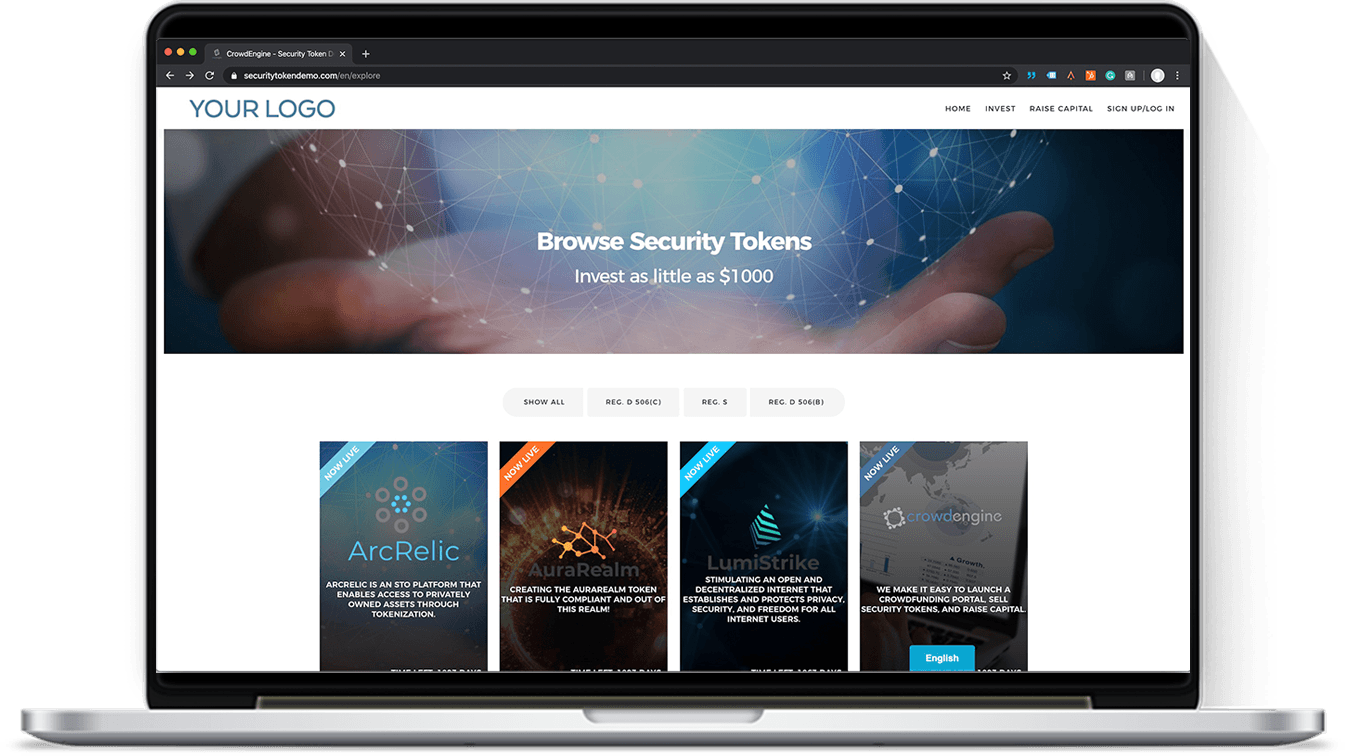

Public Sales

Easily offer your STO or Security Token Offering to the general public via Reg. D 506(c), Reg. S, or Reg A+.

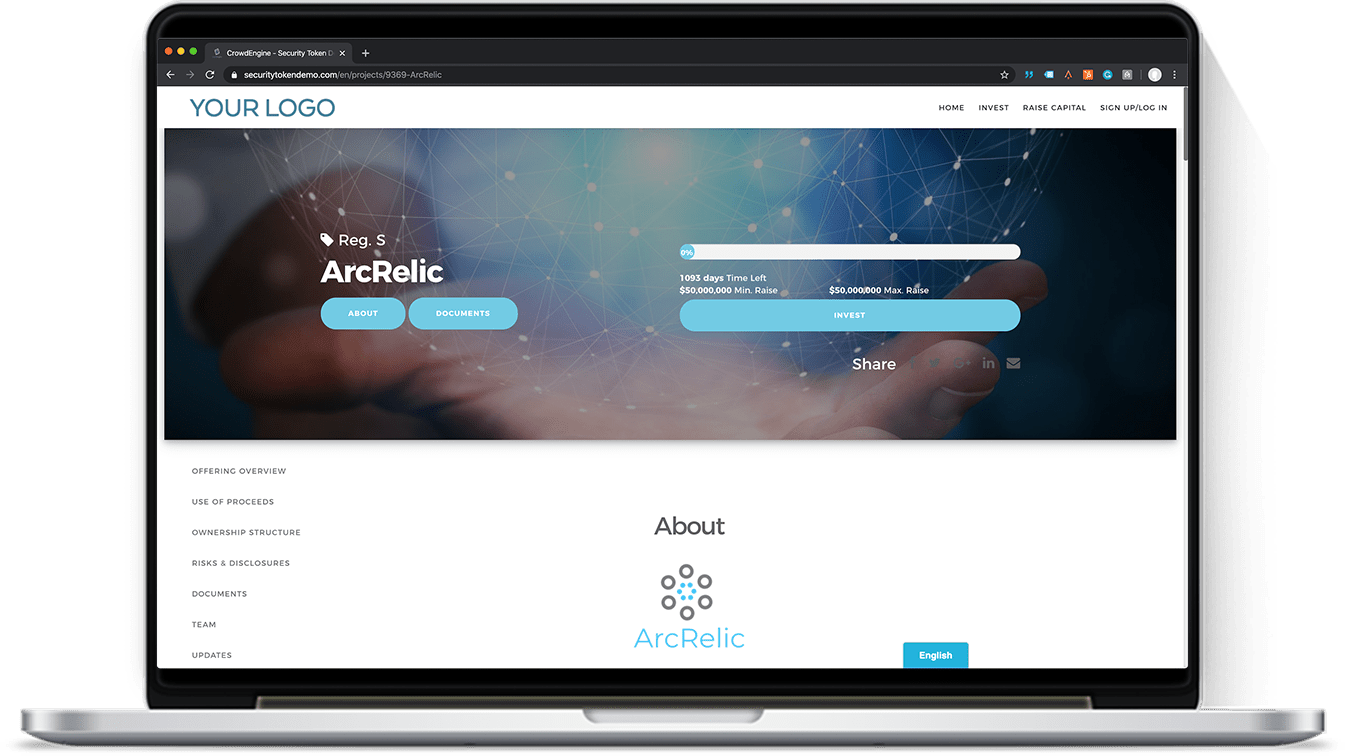

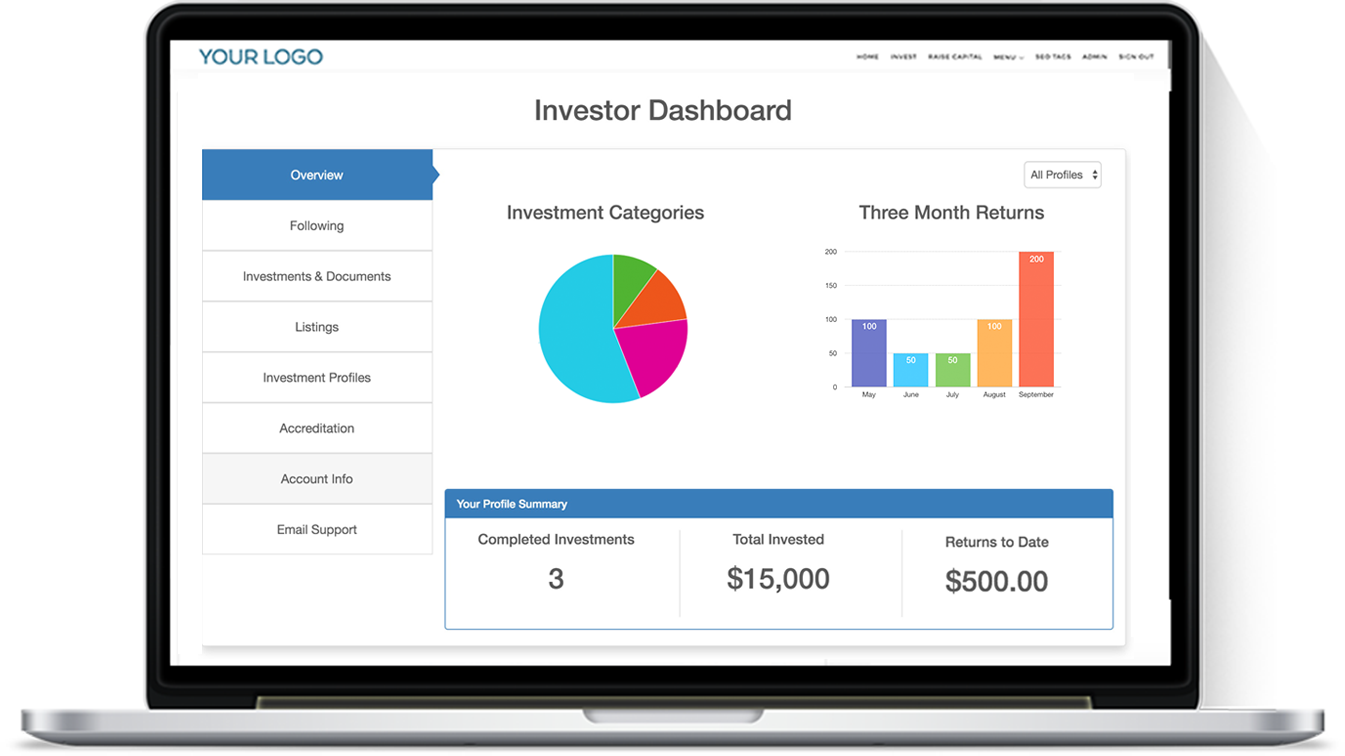

Investor Portal

An easy to use website where they can create an account, buy tokens, and track their investments.

Private Sales

Hold a private STO for only to approved investors with Reg. D 506(b) and automate due diligence.

Due Dilligence

Our system ensures tokens are only sold to investors who pass automated accreditation & AML checks.

Whitelisting

Whitelist investors with automated KYC/AML, accreditation, and identify verification.

Blockchain Use Cases

See how clients have utilized CrowdEngine in their blockchain projects.

Frequently Asked Questions

Here are some common questions we receive about our Security Token Offering solutions.

A Security Token Offering or STO is a type of offering of a cryptocurrency or “token”. This is a digital asset that holds monetary value and can be traded and sold on an exchange. Because it’s a security, all SEC compliance requirements apply to these offerings. CrowdEngine can help you to ensure these are met while making the investment process easy for your investors. Contact our sales team to learn more.

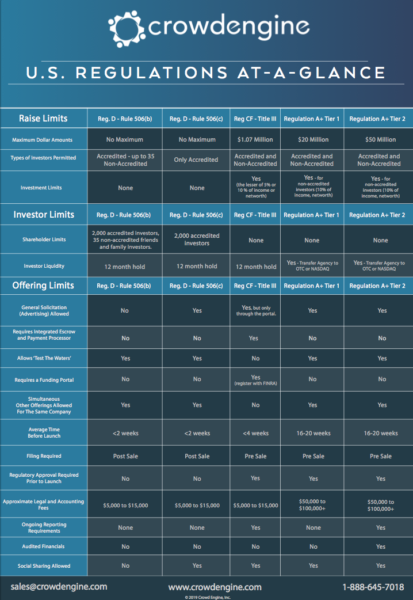

This depends on the regulation being used to hold the STO. Typically an STO using CrowdEngine is done via Reg. D 506(c) and does not have a maximum raise limitation but requires investors to be U.S. residents and accredited. However, CrowdEngine can also offer Regulation A+ ($50 million maximum) and Regulation S for non-accredited and international investments.

Since we build the Security Token portal custom for you, it’s hard for us to estimate how much your solution will cost. First of all, our sales team can help to qualify you and identify if we are a good fit. At that time we’ll come up with an estimated setup and monthly cost.

You can definitely try it! We understand the time/cost of building a platform, and we calculate it would take at least $1mil to achieve what our solution can provide day one. See our Build Vs. Buy guide for more information.

Resources

CrowdEngine adds support for Polymath

CrowdEngine enables Polymath issuers to easily and quickly onboard investors for security token offerings.

Regulations At-A-Glance

Questions about regulations? Download our Regulations at a Glance guide for free.

CrowdEngine - Compliance Capabilities

Learn how our industry-leading technology can help you maintain compliance in nearly every major jurisdiction.