Real Estate Investor Management & Automation

Make Investors Happy

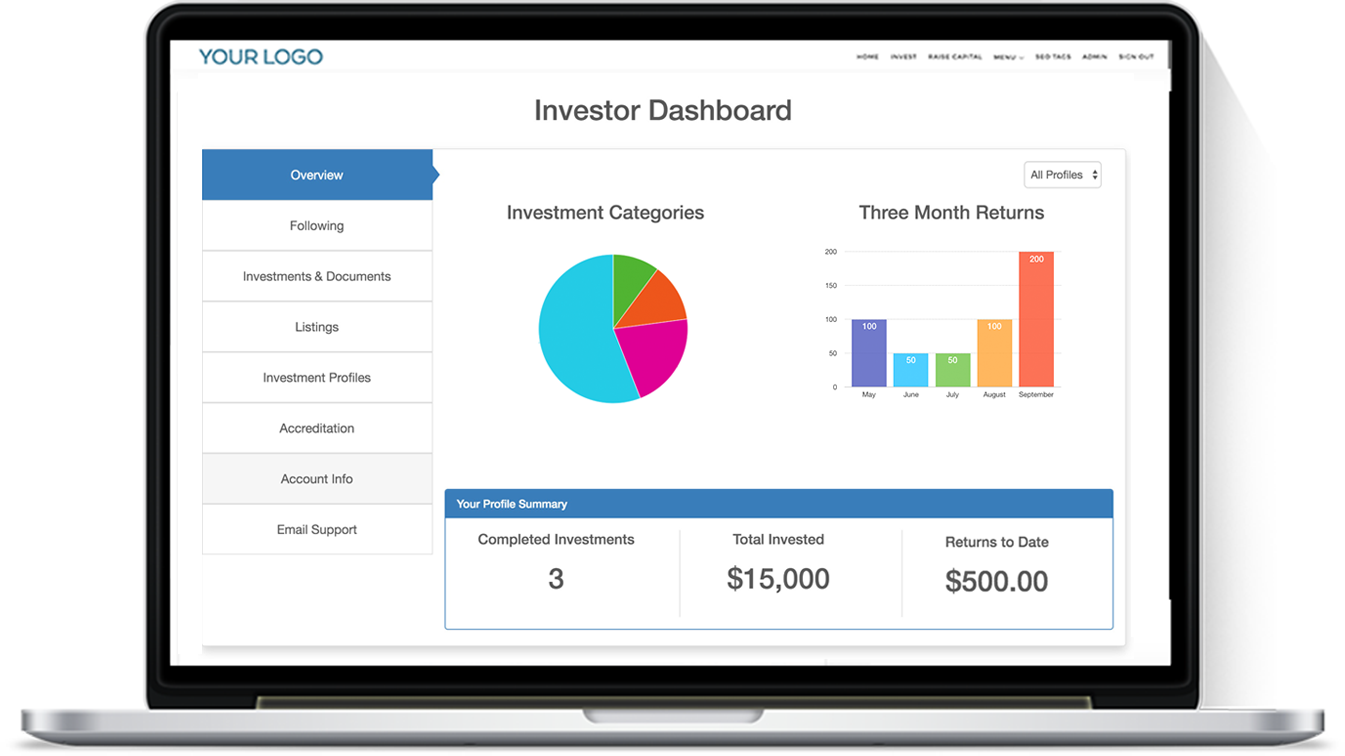

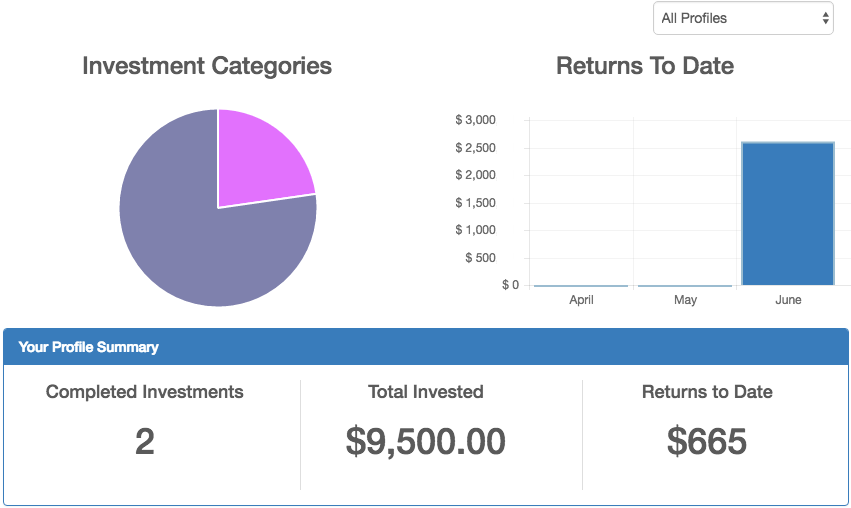

Giving investors the ability to make and manage their investments online is no longer optional. Dashboards, charts, documents, tax forms, earning reports, messaging, and more. We can even build custom reports for your specific needs.

Automate Your Business

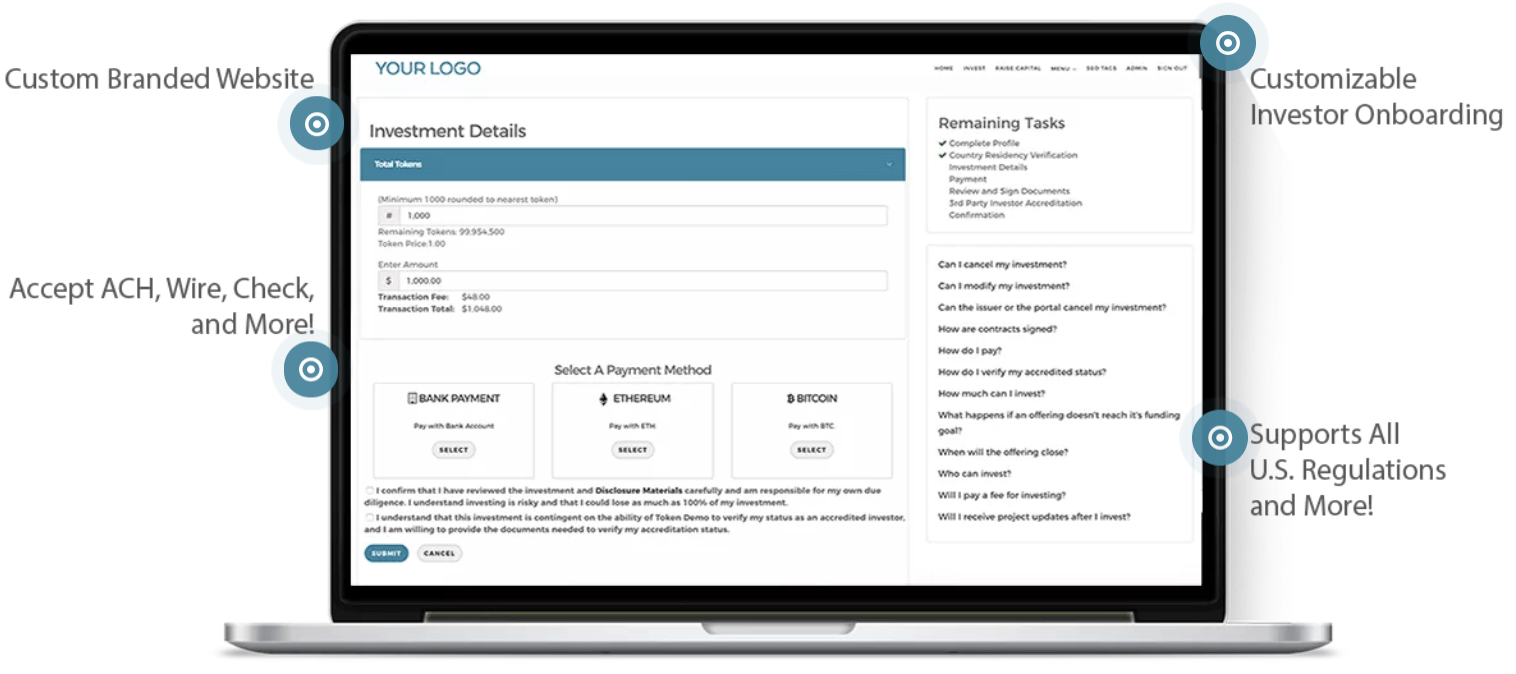

From investor onboarding to back office management, our software can help you reduce risk, save time, and ensure compliance.

More Flexibilty

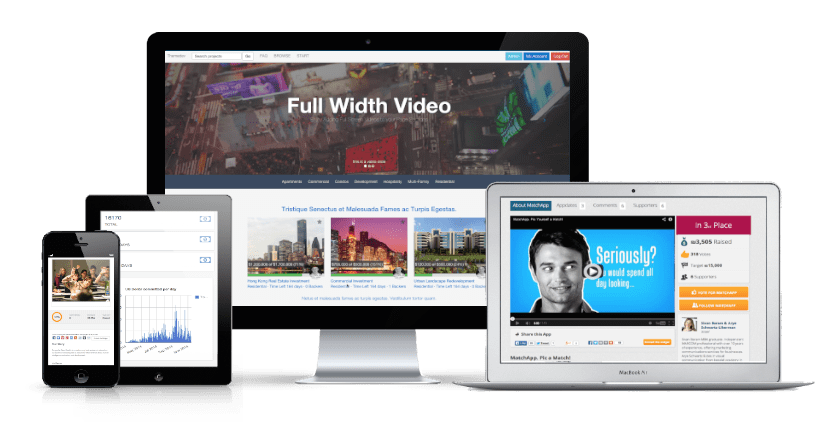

We can customize our software for your specific business needs or optionally license our front-end source code for and use your own front-end developer. We also offer an API for building custom apps or integrating reports in your legacy applications.

Key CRE Features

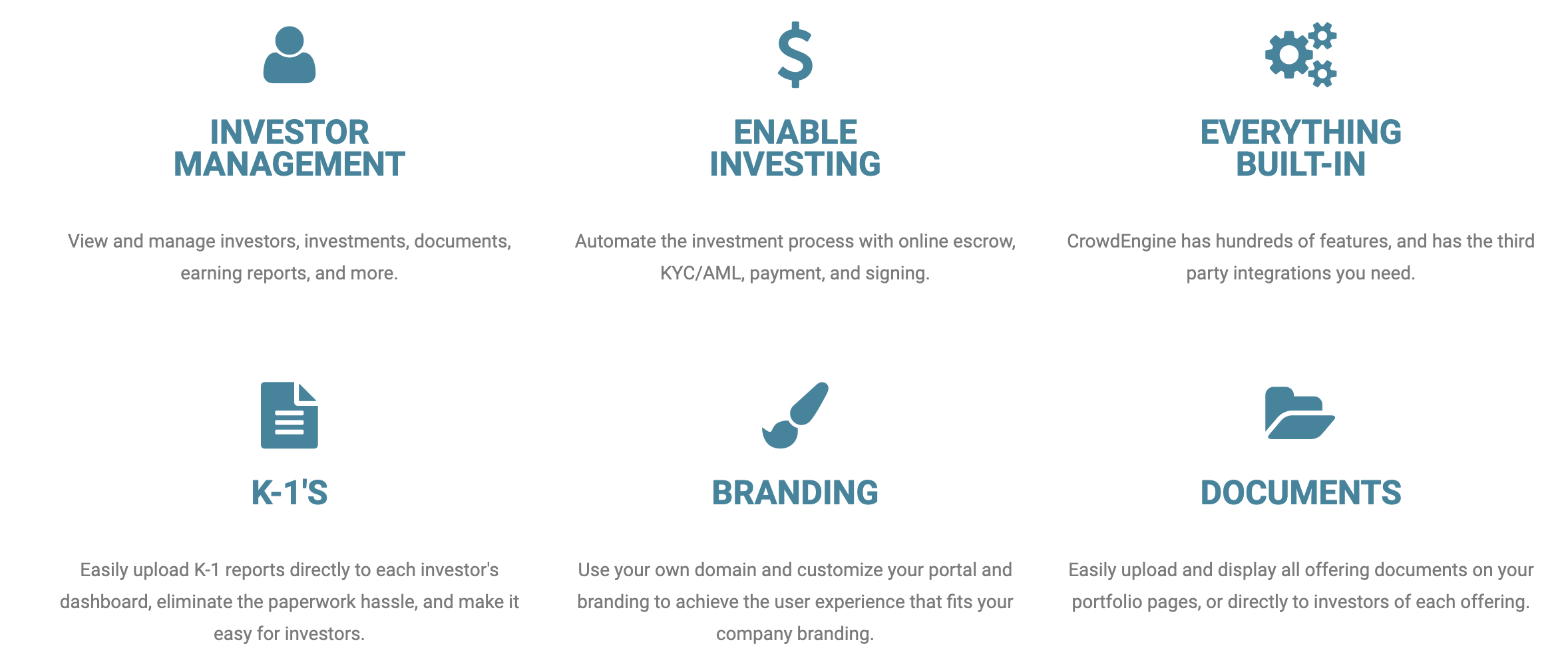

We have 100's of customizable features, but here are a few top features for Real Estate.

Investor Portal

Deal Rooms

Document Management

Online Payments

Syndication

Compliance

Ready to upgrade to state-of the art?

Real Estate Features

Our Real Estate Crowdfunding Platform Features Explained

Core Functionality

- Showcase properties you are raising capital for

- Automate compliance and investment process

- Streamline the management of the investors & distributions

Benefits for Real Estate Developers and Brokers

- Access to more capital

- Leverage the power of the internet to find new deals and investors.

- Leverage the power of the internet to find new deals and investors.

- Control and own the investor relationship from start to finish

- Don’t send your most valuable capital resource to another business to make an investment.

- Often those businesses will provide them with competing offers before they invest.

- Hijack the relationship and dilute their value to your organization and they have less capital to dedicate to your projects.

- You often pay the 3rd party commissions as they take ownership of your valuable investors.

- Don’t send your most valuable capital resource to another business to make an investment.

- Promote your own brand and business, not a 3rd party’s.

- Don’t spend money promoting someone else’s business when raising capital in order for your offering to fund.

- Spend your marketing dollars only promoting your brand and the value you provide your investors.

- Remove the ability for investors to shop unrelated offerings on the same portal promoting yours.

- Marketing costs increase as investment conversions decrease as investors you paid to view your offering begin shopping other offerings instead of investing.

- You control all the marketing, updates, and follow-up frequency to your offering(s).

Showcase your real estate offerings

- From your site and brand.

- Your style, brand, and logo on every page, including a page for your online pitch book with videos, images, charts, graphs, tables, and the text you choose to highlight your offering.

- Custom fields can be added to offerings and investor profiles.

Compliance Engine™

- SEC & FINRA compliant

- Reg D 506(b) & 506(c), Reg A+, Reg CF ready

- Customizable Rules Engine

- Ensure Complete Compliance

- Audit protection

- All data and data changes are serialized, tracked, and stored.

- All investor communications from the portal are logged and stored.

- Compliant user experiences for each offering type you choose to leverage on your portal to offer capital in your jurisdiction of choice. Once the client sets user experience and guidelines with their legal counsel, those compliance standards are automated and automatically enforced through your offering.

- Audit protection

Investor Control and Confidentiality

- Keep and Manage your investors directly, no competing portal or other offerings distracting your investors or interfering with your relationships.

- Drive traffic to your own site, not a 3rd party.

- No diluted investments.

Automate and Streamline the Entire Compliance and Investment Process

- Investment tracking

- Automated investor follow-up with incomplete investments.

- Compliance tracking – track every signature, accreditation, KYC or AML check on the portal as an admin or by 3rd party service providers.

Manage Investors & Online Distributions

- Manage the investors post offering with integrated CRM services such as Hubspot and Salesforce.

- Document repositories

- Investor dashboards

- Notification systems, Annual report delivery, K1 distribution, Bi-directional investor payments.

Simplify your capital offering

- Easy setup with no coding required to set up or operate.

- Straightforward process to load offerings with appropriate guidelines and user experiences applied to each offering type.

- Save time, money, and energy by having one central location for all investment activities and processes associated with the offering.

- When appropriate, limit which investors enter the deal room by adjusting the access control settings.

- Point and click offerings and investor management. Visually see the progress of each offering and investor participation in real-time.

- Investors see their investment results visually via graphs and tables in addition to their document repository which stores all their investment documents associated with the offering in one location.

- Issuers/sponsors and admins own and access all user data at any time.

Marketing

- Marketing and site analytics of your choice can be integrated.

- Facebook and Google pixel tracking.

- Create and display the perfect presentation with an online pitchbook of your offering with the use of videos, images, infographics, text, charts, and tables.