- Compliance Reg. CF Security Tokens

- Jun 22

Raise Capital from Non-Accredited Investors

Over the last 80 years, the only means for raising capital for private companies was through investors accredited with the SEC – just 2% of the wealthiest U.S. citizens. But, on May 16, 2016, the JOBS Act went into effect, allowing private companies in their early stages to raise capital from all Americans, so long as the appropriate criteria are met. So, startups can now use the Regulation CF exemption to crowdfund up to $1.07M in additional capital with equity investments, turning their customers into investors and getting their projects off the ground.

This means that entrepreneurs who want to use a SAFT or sell security tokens to crowdfund their project can open up a much bigger investor market than ever before, which works great for B2C business models. It can also be done once every 12 months, at the same time as any other U.S. offering (Reg. D).

I’m starting a project, what do I need to know?

There are many requirements for eligibility to the program, a brief summary is that project developers must:

- Provide certain information to investors, including basic information about the company and a description of the ownership and capital structure of the issuer

- Provide ongoing disclosure to be posted on the SEC website within 120 days of the issuing entity’s fiscal year-end

- Provide financial statements covering the two most recently completed fiscal years. Depending on the amount raised there are increasing amounts of certification required by the principal executive officer and a CPA, potentially requiring an audit

- File Form C and make it public before the offering to investors

The best part is you don’t have to be any particular type of company, all kinds of businesses benefit from this exemption. If you have an innovative idea or have found a great way to do business in your industry then why not help your company grow? Tons of interesting projects are already raising money on these platforms. From breweries to blockchain developers, small businesses are raising capital from the American public, making themselves and smaller investors better off.

These services can connect you with investors looking to contribute as little as $100, all while taking care of the regulatory headache so that you can focus on what is important – making your company as successful as it can be.

What kinds of information do these services consider when finding investors?

If you’re an entrepreneur you may be thinking about doing this yourself, but without the help of a funding platform or broker, it can be a lot to manage. Reg CF lets project developers use crowdfunding services like FundMe to raise up to $1M in investment from the general public. Historically any entity offering securities to the public had to register with the SEC under the Securities Act of 1933, but by using the “crowdfunding exemption,” Section 4(a) (6), added to the Securities Act by the JOBS Act, entrepreneurs, and their authorized funding platforms can raise funding from the general public so long as their investors follow these guidelines:

- The aggregate amount sold to “all investors,” which includes any amount sold in reliance on the crowdfunding exemption, may not exceed $1.07M in any 12-month period.

- Language in the JOBS act seems to imply that offerings made under the authority of other exemptions (such as Regulation D) may count towards the $1.07M. However, the SEC views the act as intending to supply crowdfunding as an additional source of funds for new companies, so this $1.07M limit only applies to funds raised under Section 4(a) (6), and sales under any other exemptions will not affect the limit.

- Investors are limited in how much they may invest in any Reg CF project during a 12-month period, these limitations fall under two categories:

- If the annual income OR net worth of the investor is less than $107,000 then the investor is limited to the greater of $2,200 or 5% of the lesser of his/her annual income or net worth.

- If an investor’s annual income AND net worth are both greater than $107,000 then they are limited to 10% of the lesser of his/her annual income or net worth, up to a maximum investment of $107,000

The FundMe funding platform manages the fraud prevention and compliance requirements, lets you open and manage investor accounts, provide educational materials and proper risk warnings, and get the informed consent from investors that they are taking a calculated risk. All of this is extremely important because it makes sure that your business is protected from regulatory penalties and investor backlash if your business has some trouble along it’s path to success.

Funding platforms ensure that your business is compliant with Reg CF and seamlessly reaches a national network of investors. Crowdfunding is already working for all kinds of businesses and consistently helps them exceed their funding goals. If you think crowdfunding could be the way forward for your business, then an established funding platform makes raising capital from the largest investor market in history easy and affordable, check out Fundme.com to learn more.

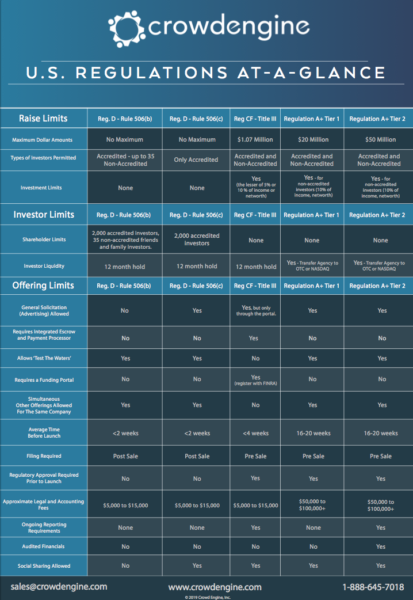

Regulations At-A-Glance

Questions about regulations? Download our Regulations at a Glance guide for free.