- Reg. CF

- Nov 03

CrowdEngine: Reg CF Crowdfunding Made Easy

For all who have waited for and dreamt about the passage of new Title III Crowdfunding laws, the day has finally come. This news brings with it a monumental change to the Equity Crowdfunding industry and time to execute on the preparations you’ve been making for the last 1-3 years and establish your place in a new industry on the verge of explosive growth and opportunity. The big question now is how?

(For those unfamiliar with Title III of the JOBS Act and its bearing on the U.S. Equity Crowdfunding industry, here is a brief overview.

To review the final rules (686 pages of them), click here.

With Title III, it will come to an unprecedented demand for investment opportunities that circumvent both Wall Street and the traditional rules of private equity investment. Gone are the days of the pervasive “Old Boy” barriers. Equity crowdfunding will now join the ranks of those services whose promise lies in providing access to previously restricted avenues of wealth creation for millennials and baby boomers alike.

The easiest way to broadcast these opportunities and facilitate transactions is via an interactive Equity Crowdfunding Portal. Equity Crowdfunding is the name given to the process whereby people (the “crowd”) invest in an unlisted company (a company that is not listed on a stock market) in exchange for shares in that company. This also encompasses Realty Crowdfunding, wherein a platform offers individual investors a chance to buy shares in a real estate project. In that case, the returns are generated from both the rental stream and the appreciation of the property itself.

Platforms of this nature already exist to supply investment firms and brokerages with portals by which they can attract accredited investors to their offerings. However, with Title III and the new rules allowing for unaccredited investors to participate in these offerings, the market is on the brink of an explosive expansion. This requires existing platforms to either quickly adapt to changing demand, or make way for new solutions.

Enter CrowdEngine, which began in 2012 as a premier white-label platform provider, and has already helped over a hundred firms raise more than 2 Billion in funding via a state-of-the-art solution uniquely architected to meet the needs of both institutional and individual investors and investment providers. CrowdEngine has bridged the gap between different equity and real estate portal providers, becoming the only service in the industry to develop the technology that allows for offerings of any type (Reg D, Reg A+) and of any jurisdiction (Intrastate, International) to coexist on the same portal. This means that CrowdEngine is already prepared to launch portals offering Title III-ready investments, and will continue to offer portals already adapted to ever-changing crowdfunding law, as well as different target markets.

CrowdEngine’s creative flexibility allows nearly any brand, site, or organization looking to provide capital raising opportunities to effectively represent itself through a crowdfunding portal. Portal owners no longer have to become technology experts to showcase their deals and provide their investors with a premier user experience. Because each CrowdEngine portal owner can personally manage their compliance and investment standards, there are no technological roadblocks to providing investment opportunities to the general public as well as accredited investors.

The only true bottleneck of growth that remains in the equity crowdfunding industry is not one of demand, but rather of supply. Those early adopters who can provide a marketplace to showcase various types of offerings and therefore satisfy the rapidly growing demand of a new audience will quickly become market leaders. CrowdEngine’s turnkey solution makes this all possible.

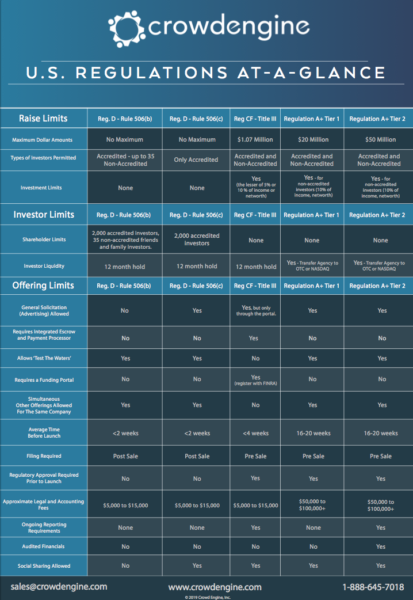

Regulations At-A-Glance

Questions about regulations? Download our Regulations at a Glance guide for free.