Intro to Security Tokens

Security tokens have become a hot topic in the finance and blockchain communities. In this article, we will explain in detail what security tokens are and how they differ from a utility token.

Concept of a Security Token

To understand what security tokens are, we first need to understand securities. What is a security?

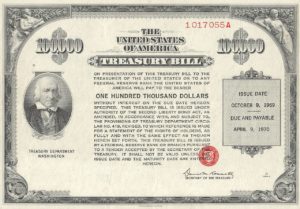

Securities are a financial instrument issued by a company or government agency that denotes an ownership interest and provides evidence of a debt, a right to share in the earnings of the issuer, or a right in the distribution of a property. Securities include bonds, debentures, notes, options, shares, and warrants but not insurance policies, and may be traded in financial markets such as stock exchanges.

Securities are a financial instrument issued by a company or government agency that denotes an ownership interest and provides evidence of a debt, a right to share in the earnings of the issuer, or a right in the distribution of a property. Securities include bonds, debentures, notes, options, shares, and warrants but not insurance policies, and may be traded in financial markets such as stock exchanges.

Here is the definition straight from the Securities Act of 1933.

Under Section 2(a)(1) of the Securities Act, the term “security” is defined as

any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral trust certificate, preorganization certificate or subscription, transferable share, investment contract, voting-trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security, certificate of deposit, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as a “security,” or any certificate of interest or participation in, temporary or interim certificate for, receipt for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing.

Now we can answer the question, what is a security token?

What is a Security Token?

Tokenized securities are just securities with an electronic wrapper around them. Essentially, you’re taking something that today you have on paper, and you’re putting an electronic wrapper around it. The value of this electronic wrapper is that it makes security tokens easier to trade in a way that complies with the appropriate regulations.

The best analogy is the transition from email to snail mail. You can type out a written communication, print it out, put it in an envelope, address it, send it, and wait two to three days. Or, you could hit send on an email. The content is the same, but by putting an electronic wrapper around it, you can send it faster, cheaper, and easier.

To put it in context, you could have the same investor agreement or certificate on paper. It’s the same thing, but now it has an electronic wrapper, so now I can issue it and trade orders of magnitude faster, cheaper and easier.

Understanding the difference between Utility Tokens vs. Security Tokens

At the most basic level, tokens can be divided into two types: utility tokens and security tokens.

Unlike security tokens, the concept of utility tokens is relatively well understood in the blockchain space today. Utility tokens represent future access to a company’s product or service. The defining characteristic of utility tokens is that they are not designed as investments; if properly structured, this feature exempts utility tokens from federal laws governing securities.

By creating utility tokens, a startup can sell “digital coupons” for the service it is developing, much as electronics retailers accept pre-orders for video games that might not be released for several months.

On the other hand, security tokens represent complete or fractional ownership interests (like shares or stock) in things like startups, public companies, real estate, art investments, intellectual property, or even professional sports teams. If a crypto token derives its value from an external, tradable asset, it is classified as a security token and becomes subject to federal securities regulations. Failure to abide by these regulations could result in costly penalties and could threaten to derail a project.

However, if a startup meets all its regulatory obligations, the security token classification creates the potential for a wide variety of applications, the most promising of which is the ability to issue tokens that represent shares of company stock.

Howey Test

In the US, any instrument defined as a “security” is regulated by the Securities and Exchange Commission (SEC), including security tokens. Even though it may sound straightforward, the legal definition of a security is quite complex, and many coins sit uncomfortably between the categories of “utility” and “security.”

Background of the Howey Test

In 1946, the Supreme Court heard a case (SEC v. Howey) that concerned whether a leaseback agreement was legally an investment contract (one of the types of investments that is listed as a “security” under the Acts). In Howey, two Florida-based corporate defendants offered real estate contracts for tracts of land with citrus groves. The defendants offered buyers the option of leasing any purchased land back to the defendants, who would then tend to the land, and harvest, pool, and market the citrus. As most of the buyers were not farmers and did not have agricultural expertise, they were happy to lease the land back to the defendants.

The SEC sued the defendants over these transactions, claiming that they broke the law by not filing a securities registration statement. The Supreme Court, in issuing its decision finding that the defendants’ leaseback agreement is a form of security, developed a landmark test for determining whether certain transactions are investment contracts (and thus subject to securities registration requirements).

Under the Howey Test, a transaction is an investment contract if:

- It is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

A 15,000-acre orange grove at Howie in the Hills. Photographed on April 2, 1930.

Image Courtesy of the State Archives of Florida.

Conclusion

Whether you think this is a positive thing or not depends, mainly, on your perspective. By understanding the building blocks of the securities law, you gain a fundamental understanding of the value security tokens will unlock one day. For those of you coming from traditional forms of finance and investing, security tokens provide the ease and speed of blockchain without sacrificing legal protection. For those of you coming from a background in blockchain investing, security tokens offer improved protection against fraud. Moreover, security tokens are here to stay, and the benefits that will be achieved through security tokens are groundbreaking for both public and private securities.

Disclaimer: This information is provided to our clients and other friends for educational purposes only. CrowdEngine is not guaranteeing any information as reliable or accurate, and that it’s subject to change at any time. It should not be construed or relied upon as legal advice. Please contact your accountant and or lawyer with respect to any of the matters discussed here.

This post was written by Lanli Pham